The increasing urgency to rethink business, programs, investments, and strategies is driven by the shifts in the IT infrastructure, particularly in open source projects. Delving into the modern IT infrastructure, starting with the time series database that we are dedicated to, is an excellent way to kick off this journey.

What is the Trend in the TSDB Market?

The DB-Engines Ranking provides a monthly update on the popularity of different DBMS (Database Management Systems). Chart 1 illustrates the historical trend of category popularity from April 2020 to June 2022. From the chart, it is evident that time series databases (TSDBs) have consistently outperformed other categories since April 2020 and continue to gain momentum.

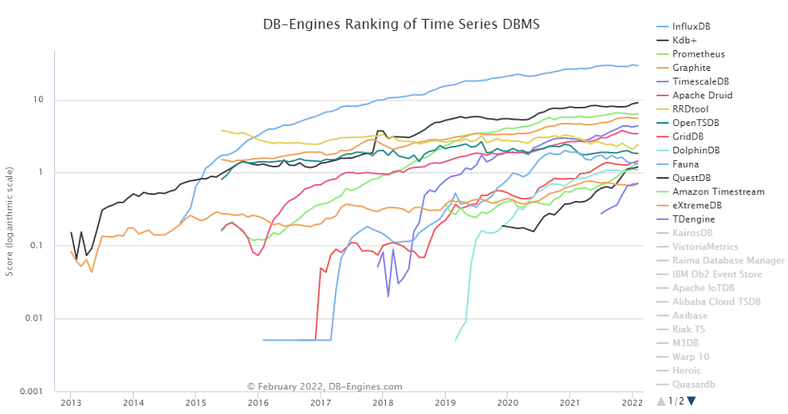

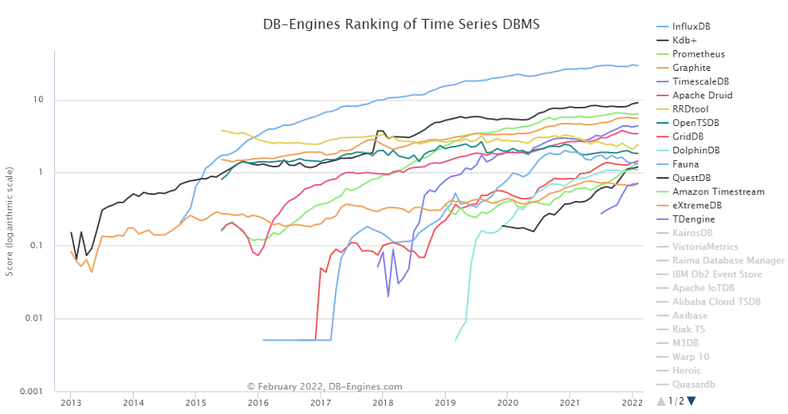

According to Chart 2, InfluxDB is currently the most popular and widely used time series database worldwide.

InfluxDB, developed by InfluxData and headquartered in San Francisco, is a time series database designed to provide real-time visibility into stacks, sensors, and systems. Its purpose is to empower developers and organizations in building real-time IoT applications.

However, InfluxDB does have some weaknesses. Firstly, high-cardinality datasets pose a significant challenge for InfluxDB due to its underlying architecture, particularly the Time-series Index. Secondly, the efficiency of writing and reading data is not as optimal as it used to be. With cloud data centers handling 94% of all workloads, users require fast, agile, scalable, and stable cloud solutions for long-term usage. This is where cloud-native technology comes into play. However, due to the nature of cloud-native tendencies, the efficiency of write and read operations achieved by using mmap on local disks cannot be maintained after cloud migration. To address this, a new storage engine called IOx is actively being developed to handle large volumes of data and diverse user scenarios.

Open source projects and startups share similar goals with other tech projects. They strive to find ways to handle larger data streams, perform more complex analytics, and operate in more efficient silos. In the Chinese market, projects like CnosDB, IoTDB, and TDengine are dedicated to leveraging open source products and communities to address the challenges faced by global competitors.

Is TSDB in a Niche Market?

In recent years, time series databases have experienced the fastest growth among database segments, driven by the rapid expansion of IoT, big data, and artificial intelligence technologies. These technologies necessitate the processing and analysis of vast amounts of time series data at high ingestion rates.

Analyzing market needs provides insight into the time series database market. Three key factors drive its size and development: 1) The number of IoT devices, 2) The number of sensor devices, and 3) Pricing. According to data from Statista, the global number of IoT devices is projected to reach 75 billion. Assuming an average of 10 sensors installed per device, this would result in a demand for 750 billion sensors. Clearly, both IoT devices and sensors are experiencing significant growth.

Regarding pricing, the average charge is currently around $0.14 per sensor. Even with intense competition, if the price were to decrease to, for instance, $0.02 per sensor, it would still be a multi-billion-dollar market. While this estimation may be conservative, it indicates the direction of market growth.

TSDB Usage Scenarios

From medical sensors to autonomous vehicles, financial fluctuations to your refrigerator, practically anything can be connected, resulting in an astronomical flow of data. When dealing with such near-infinite data, a time series database becomes invaluable in making sense out of chaos. One typical market for TSDBs is IoT, where remote devices continuously capture metrics for analytical purposes.

Currently, it appears that all players in this market segment are benefitting from the rising interest in IoT and IIoT (Industrial Internet of Things), with ongoing deployments and increasing enthusiasm. This is just the beginning of what promises to be an exhilarating race, with multi-billion dollar rewards at stake.

Reference

Excerpted from CISCO website, https://newsroom.cisco.com/c/r/newsroom/en/us/a/y2018/m02/global-cloud-index-projects-cloud-traffic-to-represent-95-percent-of-total-data-center-traffic-by-2021.html, February 2018.